[Deprecated] Sperax Gauge

Introducing SPA Gauge

The SPA Gauge is the newest feature on app.sperax.io. Demeter exists for Arbitrum projects to execute fair token launches and acquire deep, on-chain liquidity. The SPA Gauge is a new reward mechanism that emits SPA rewards to USDs trading pairs.

Any DAO on Arbitrum can use USDs and the SPA gauge to launch a token or improve a token’s on-chain liquidity. Projects simply launch a trading pair with USDs, after which they are automatically able to receive SPA rewards from the gauge.

Time to Prioritize On-Chain Liquidity

Instead of doing centralized exchange token offerings, young projects now have the option to use decentralized alternatives. Benefits of going the on-chain route include:

Self Custody — In 2022 more than $3.8B in value was stolen due to mismanagement at centralized institutions according to Chainalysis.

Access to DeFi Ecosystem — Decentralized finance allows for interoperability and shared liquidity. With on-chain liquidity, your token becomes a money lego for builders and investors. 1.65B worth of assets are doing this today on Arbitrum according to DefiLlama.

Automated Market Making — With an automated market maker system, young projects can execute fair token launches and not be subject to the needs of VCs, market makers or centralized exchanges. Fees go to your community, not market makers.

Earn SPA from The Gauge

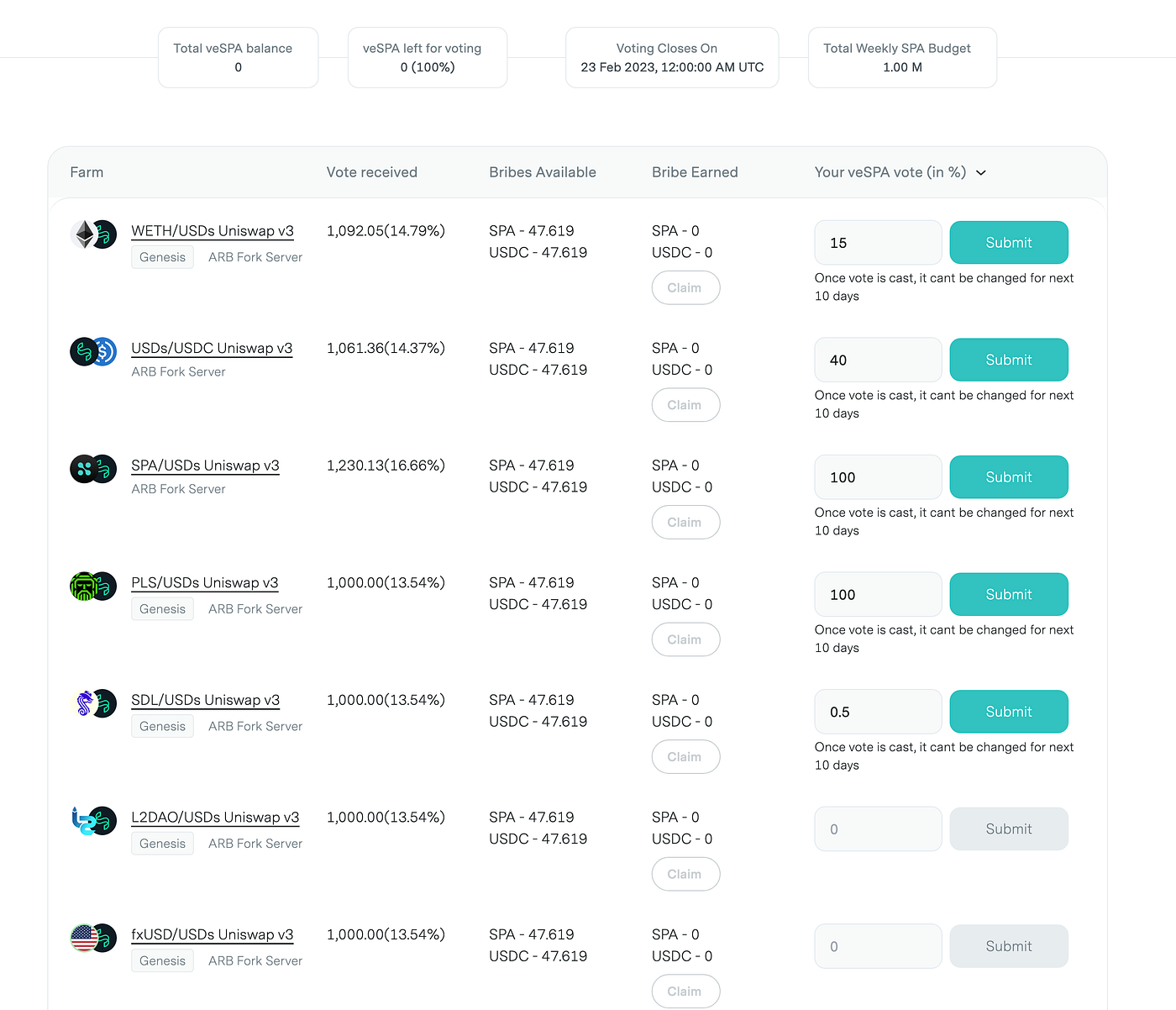

The SPA Gauge emits a predetermined amount of SPA each month. veSPA (staked SPA) holders vote to decide how the SPA rewards are distributed across the USDs pools. The voting process assigns a weight to each pool’s “gauge”. Projects can use their own governance token to bribe voters.

Voting and bribing are both done in the entirely permissionless Demeter UI. Simplicity was the top priority when it came to designing the fair launch experience.

Gauge Voting

veSPA holders participate in a weekly vote which determines how many SPA rewards are distributed to each pool. Users vote whenever they wish, but the on-chain snapshot of the votes will be taken every Thursday at 12:00:00 UTC. Increasing a pool’s gauge weight, by voting for it, results in more SPA being rewarded to that pool. Increasing a pool’s rewards increases TVL.

Bribing Voters

The SPA Gauge system allows veSPA holders to accept bribes for voting on specific gauges. When participating in the weekly vote, veSPA holders will be presented with the opportunity to collect rewards for voting on specific pools. Young DAOs can use their own governance token to bribe veSPA holders for SPA rewards. Any DAO can bribe for rewards and liquidity.

DAOs can use their native token to bribe for SPA rewards

veSPA holders earn yield in new types of tokens

Warning: The users who do not own the farms added to the Gauge typically do not need to use the "Add Bribe" button and add any bribes. This button is mainly used by the protocols to bribe veSPA holders with the protocols' tokens. Please add bribes (use the "Add Bribe" button) only in the case you fully understand what you are doing. Once the bribes are added to the Gauge it would not be possible to recover/refund them.

Getting Added To the Gauge

There are two ways for DAOs to join the SPA gauge.

Launch a USDs or SPA pair through Demeter.sperax.io

SIP and snapshot vote (custom strategies or pools)

Multi DEX Support

A unique feature to the SPA gauge is that it’s DEX agnostic. Unlike the Curve Gauge which is specific to one DEX (curve.fi), the SPA gauge can attach to USDs pairs on any DEX. The second integration will be with Camelot. Users can execute a fair launch on Camelot and Demeter. Simply launch a USDs trading pair and be connected to the SPA gauge, ready to earn SPA emissions in addition to any GRAIL or native token rewards. This can be repeated on any DEX which emerges on Arbitrum.

Sperax Primary Pools

To ensure health for the Sperax ecosystem, SPA will be used to bribe key USDs and SPA liquidity pools. veSPA stakers vote for these pools to receive SPA bribe revenue in addition to the organic SPA revenue. The below are primary pools:

SPA/USDs — Primary on-chain liquidity source for SPA, the governance token of SperaxSUD

USDC/USDs — Primary on-chain arbitrage venue for USDs, the stablecoin and revenue driver of SperaxUSD

plsSPA/SPA — Primary liquid staked derivative of veSPA, the staked version of SPA

Driving Value to SPA

The SPA Gauge incentivizes USDs circulating supply growth directly. As circulating supply of USDs grows, the SperaxUSD protocol benefits from additional protocol revenue. The launch of the SPA Gauge has multiple economic forces at play in the background:

Increasing SPA Demand

Bribe Revenue: veSPA holders (SPA stakers) benefit from a new source of yield: bribes. If they wish to collect yield in SPA, bribe primary pools. For yield in other assets, bribe alternative pools.

Increase SPA buyback: More USDs in circulation means more SPA being bought by the protocol. 25% of yield on USDs collateral and 50% of protocol fees are used to buyback SPA from the open market.

Controlling the Gauge: Protocols may wish to accumulate veSPA to control SPA emissions. Saddle and Layer2DAO have already executed token swaps with Sperax DAO to build a position.

Decreasing SPA Supply

Increase SPA Burn: More USDs in circulation means more SPA burned. 25% of yield on USDs collateral and 50% of protocol fees are used to buyback then burn SPA.

Liquid staked veSPA: PlutusDAO has pioneered the accumulation of SPA voting power by launching plsSPA. This product has locked 95M SPA forever. Other protocols can also aim to build additional liquid staked SPA derivatives.

Last updated

Was this helpful?